inherited annuity taxation irs

Annual payments of 4000 10 of your original investment is non-taxable. The earnings are taxable over the life of the payments.

Successor Beneficiary Rmds After Inherited Ira Beneficiary Passes

The SECURE Act which was signed into law in 2020 changed the rules for taxes on inherited IRAs for most.

. If the annuity is an immediate annuity. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. If you inherit a non-qualified annuity the method by which you choose to withdraw the funds will determine how you are taxed.

The government doesnt tax annuity funds until you start taking distributions in retirement. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. You live longer than 10 years.

How the SECURE Act changed the rules for taxes on inherited IRAs. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. A tax-sheltered annuity officially known as a 403b plan is a retirement plan offered by public employers such as public school districts.

Can I sell an inherited annuity. Variable annuities - make payments to an annuitant varying in amount. Fixed period annuities - pay a fixed amount to an annuitant at regular intervals for a definite length of time.

You have an annuity purchased for 40000 with after-tax money. To determine if the sale of inherited property is taxable you must first determine your basis in the property. So consult your tax advisor.

These payments are not tax-free however. If you opt to receive a lump-sum payment of all. You should receive a Form 1099-R.

Inherited Non-Qualified Annuity Taxes Because the annuity purchaser invested after-tax dollars the principal isnt taxed when distributed. It works much like a traditional. The tax rate on an inherited annuity depends on the type of annuity and the beneficiarys relationship to the person who purchased the annuity.

Tax obligations may possibly be deferred by rolling the lump-sum distribution over into an individual retirement account. According to the IRS. The basis of property inherited from a decedent is.

Because retirees usually generate less income they enjoy reduced tax rates. For estates subject to the estate. While having a guaranteed lifetime income sounds appealing it might be in your best interest to use this.

In turn taxation of annuity distributions.

Annuity Taxation How Various Annuities Are Taxed

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Beneficiaries Inheriting An Annuity After Death

Qualified Vs Non Qualified Annuities Taxes Distribution

How Are Annuities Taxed In Retirement How To Reduce Taxes

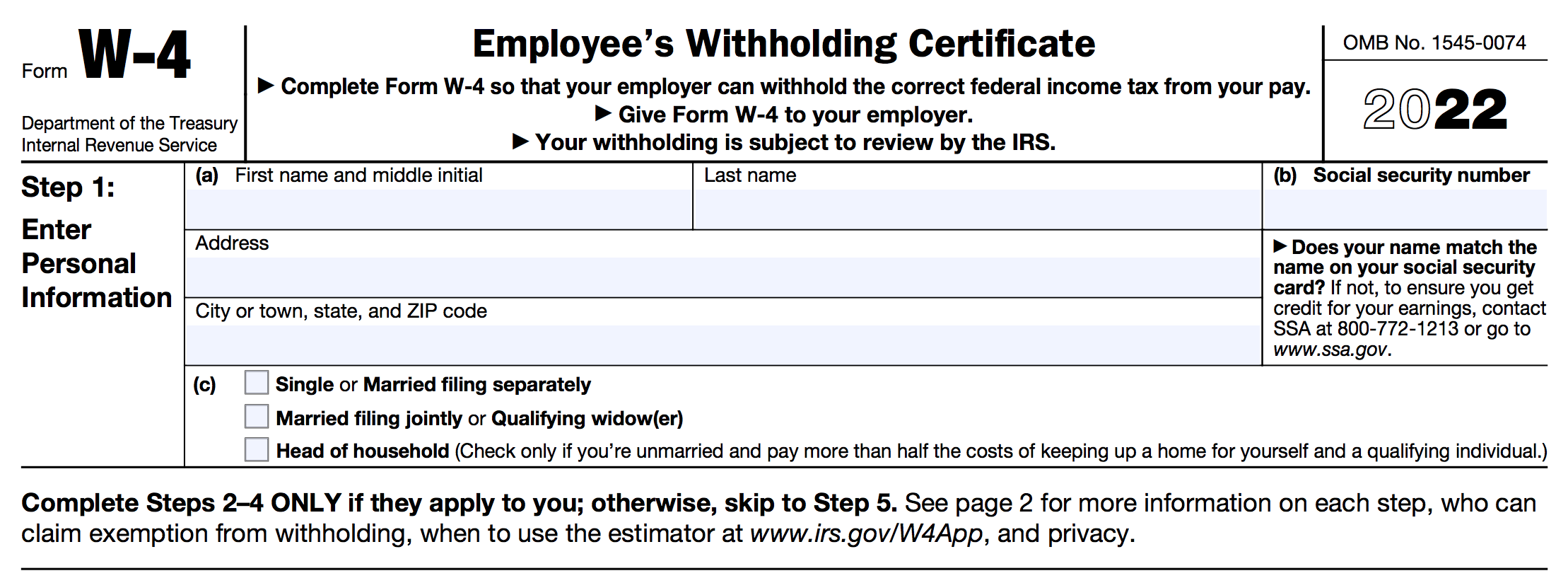

What Is The W 4 Form Here S Your Simple Guide Smartasset

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

Many People Are Inheriting Annuities And Need To Know What Choices They Have Stan The Annuity Man

Annuity Taxation How Are Annuities Taxed

Post Mortem 1035 Exchange Of Annuity Allowed Wealth Management

How Are Annuities Taxed Valuewalk

Using Form 1041 For Filing Taxes For The Deceased H R Block

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

3 Basic Options Inherited Qualified Annuity Mintco Financial

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service